How To Calculate Stock Price From Balance Sheet - You can learn how to find share price from balance sheets. Current stock price × number of outstanding shares = market value of equity. Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. The number of shares outstanding is listed in the. You will need the corporation's total stockholder equity holdings.

The number of shares outstanding is listed in the. You will need the corporation's total stockholder equity holdings. You can learn how to find share price from balance sheets. Current stock price × number of outstanding shares = market value of equity. Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts.

The number of shares outstanding is listed in the. You will need the corporation's total stockholder equity holdings. Current stock price × number of outstanding shares = market value of equity. Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. You can learn how to find share price from balance sheets.

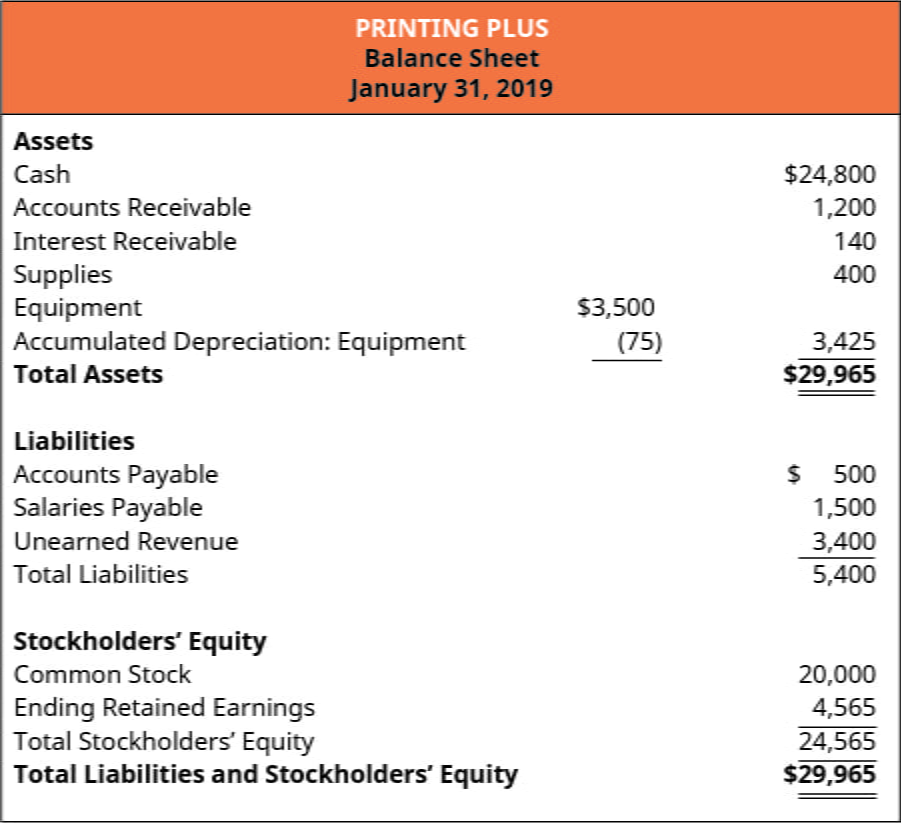

Preferred Stock On Balance Sheet sheet

You can learn how to find share price from balance sheets. Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. Current stock price × number of outstanding shares = market value of equity. You will need the corporation's total stockholder equity holdings. The number of shares outstanding is listed in the.

Outstanding Profit And Loss Calculator Excel Ifrs 16 Disclosure In

You can learn how to find share price from balance sheets. Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. The number of shares outstanding is listed in the. You will need the corporation's total stockholder equity holdings. Current stock price × number of outstanding shares = market value of equity.

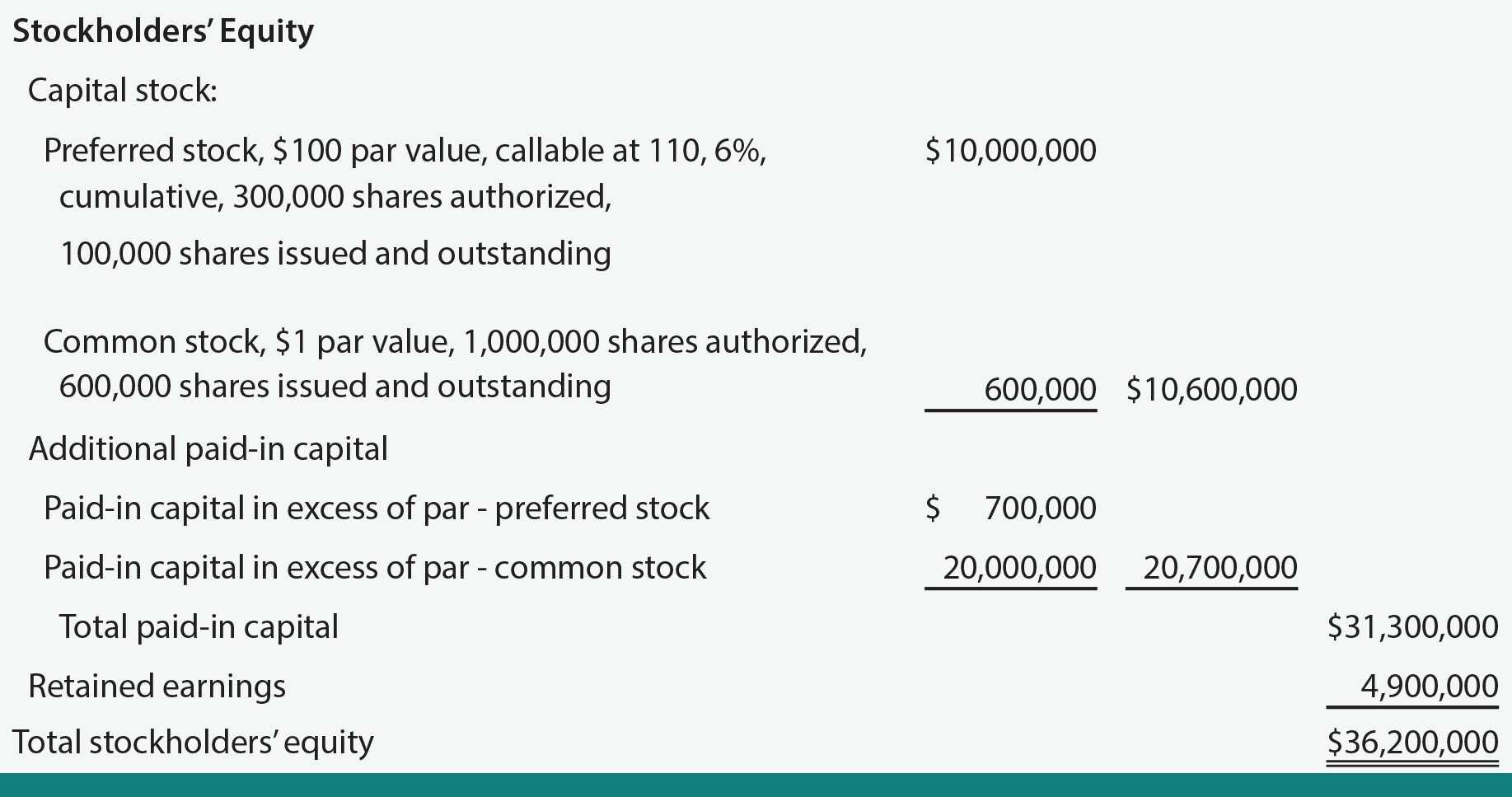

Earnings Per Share And Other Indicators

Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. You can learn how to find share price from balance sheets. The number of shares outstanding is listed in the. You will need the corporation's total stockholder equity holdings. Current stock price × number of outstanding shares = market value of equity.

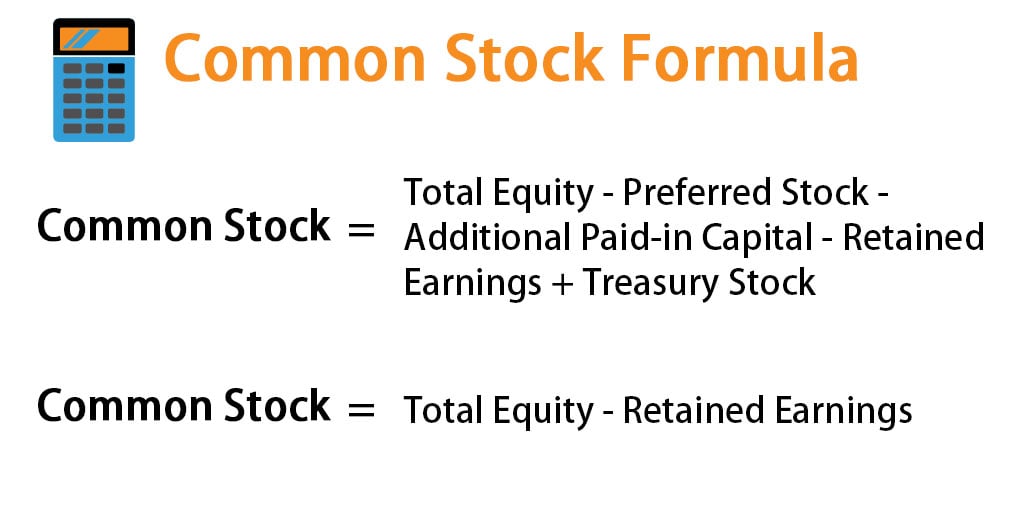

6+ Common Stock Calculator ShirelleFezaan

The number of shares outstanding is listed in the. Current stock price × number of outstanding shares = market value of equity. You can learn how to find share price from balance sheets. Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. You will need the corporation's total stockholder equity holdings.

Calculate Common Stock On Balance Sheet

You will need the corporation's total stockholder equity holdings. Current stock price × number of outstanding shares = market value of equity. You can learn how to find share price from balance sheets. The number of shares outstanding is listed in the. Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts.

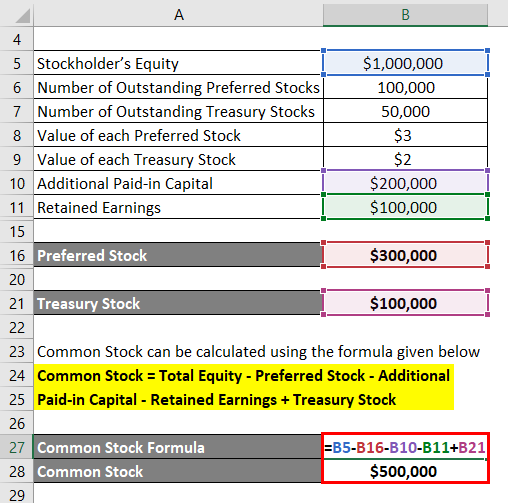

Common Stock Formula Calculator (Examples with Excel Template)

You can learn how to find share price from balance sheets. The number of shares outstanding is listed in the. Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. You will need the corporation's total stockholder equity holdings. Current stock price × number of outstanding shares = market value of equity.

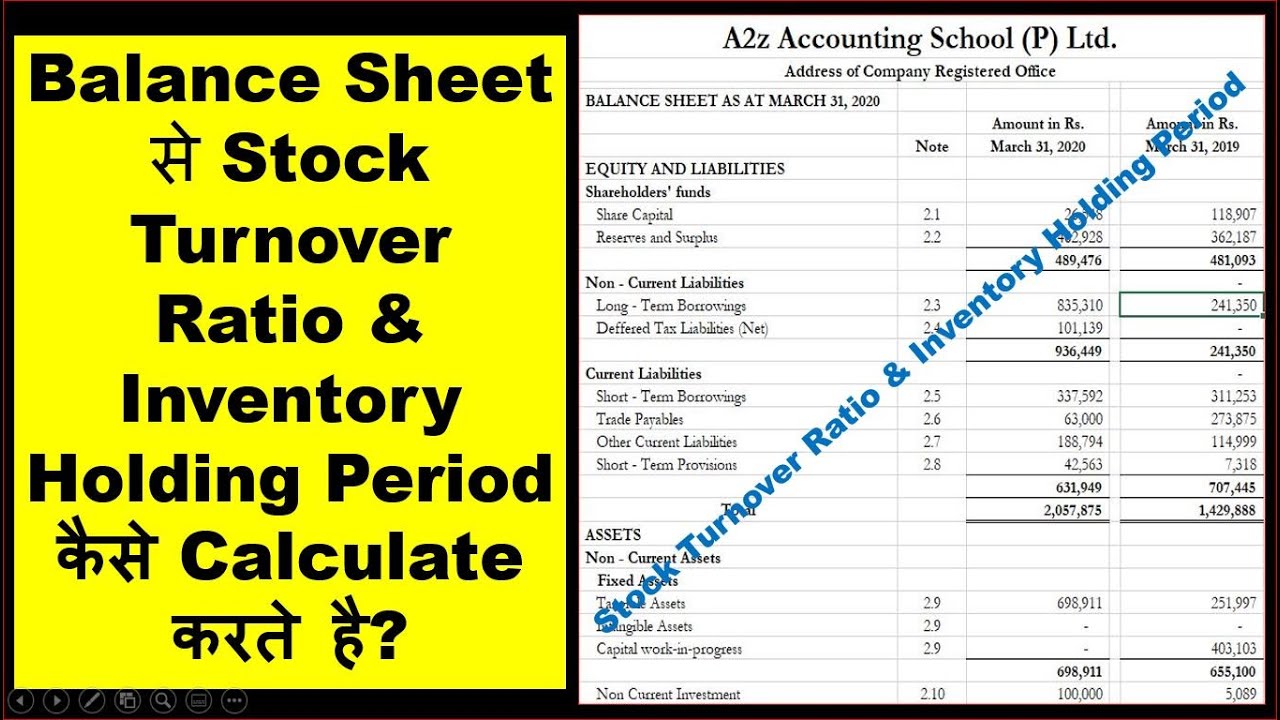

How to calculate stock turnover ratio form balance sheet ? How to

You will need the corporation's total stockholder equity holdings. Current stock price × number of outstanding shares = market value of equity. You can learn how to find share price from balance sheets. Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. The number of shares outstanding is listed in the.

Common Stock Price Calculator

Current stock price × number of outstanding shares = market value of equity. You can learn how to find share price from balance sheets. Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. The number of shares outstanding is listed in the. You will need the corporation's total stockholder equity holdings.

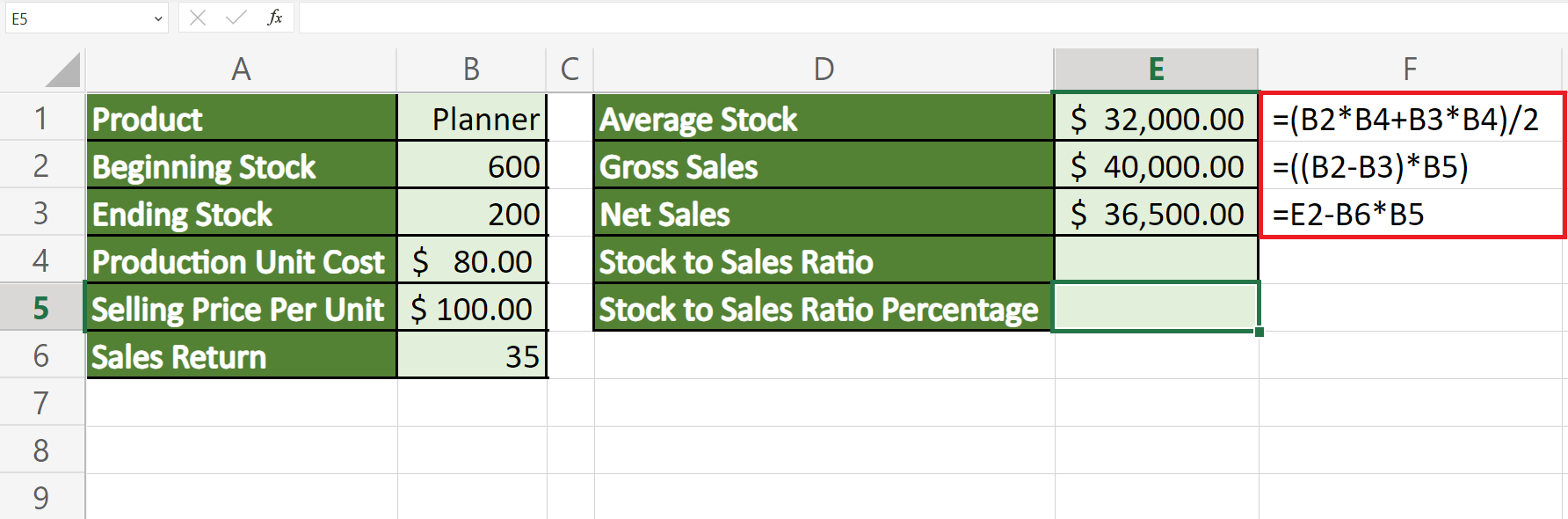

How to Calculate Stock to Sales Ratio in Excel Sheetaki

Current stock price × number of outstanding shares = market value of equity. The number of shares outstanding is listed in the. You will need the corporation's total stockholder equity holdings. Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. You can learn how to find share price from balance sheets.

BASIC EXCEL SHEET 9 CALCULATE STOCK YouTube

You can learn how to find share price from balance sheets. Current stock price × number of outstanding shares = market value of equity. The number of shares outstanding is listed in the. Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. You will need the corporation's total stockholder equity holdings.

Current Stock Price × Number Of Outstanding Shares = Market Value Of Equity.

You will need the corporation's total stockholder equity holdings. Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. You can learn how to find share price from balance sheets. The number of shares outstanding is listed in the.