Where Does Equipment Go On A Balance Sheet - Balance sheets are typically prepared and distributed monthly or quarterly depending on the governing laws and company. When equipment is purchased, it is not initially reported on the income statement. Recording equipment accurately on the balance sheet is critical for reflecting a company’s financial position. Instead, your equipment is classified as a noncurrent asset. Valuation of equipment assets on the balance sheet is initially at the purchase price, which includes the cost to acquire, deliver, and. No, your equipment is not a current asset. Is equipment a current asset? Instead, it is reported on the balance sheet as.

Instead, your equipment is classified as a noncurrent asset. Instead, it is reported on the balance sheet as. Recording equipment accurately on the balance sheet is critical for reflecting a company’s financial position. Valuation of equipment assets on the balance sheet is initially at the purchase price, which includes the cost to acquire, deliver, and. Balance sheets are typically prepared and distributed monthly or quarterly depending on the governing laws and company. No, your equipment is not a current asset. Is equipment a current asset? When equipment is purchased, it is not initially reported on the income statement.

Instead, it is reported on the balance sheet as. Instead, your equipment is classified as a noncurrent asset. Valuation of equipment assets on the balance sheet is initially at the purchase price, which includes the cost to acquire, deliver, and. Balance sheets are typically prepared and distributed monthly or quarterly depending on the governing laws and company. Recording equipment accurately on the balance sheet is critical for reflecting a company’s financial position. No, your equipment is not a current asset. Is equipment a current asset? When equipment is purchased, it is not initially reported on the income statement.

Fixed Asset Reconciliation Steps Movement Accountingi vrogue.co

Instead, your equipment is classified as a noncurrent asset. When equipment is purchased, it is not initially reported on the income statement. Instead, it is reported on the balance sheet as. Valuation of equipment assets on the balance sheet is initially at the purchase price, which includes the cost to acquire, deliver, and. Is equipment a current asset?

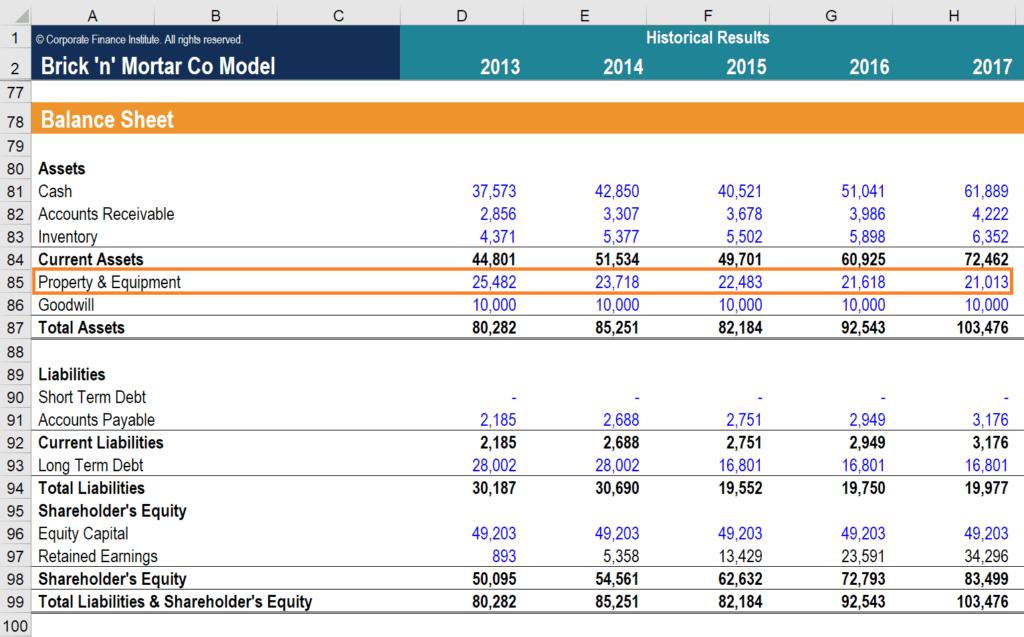

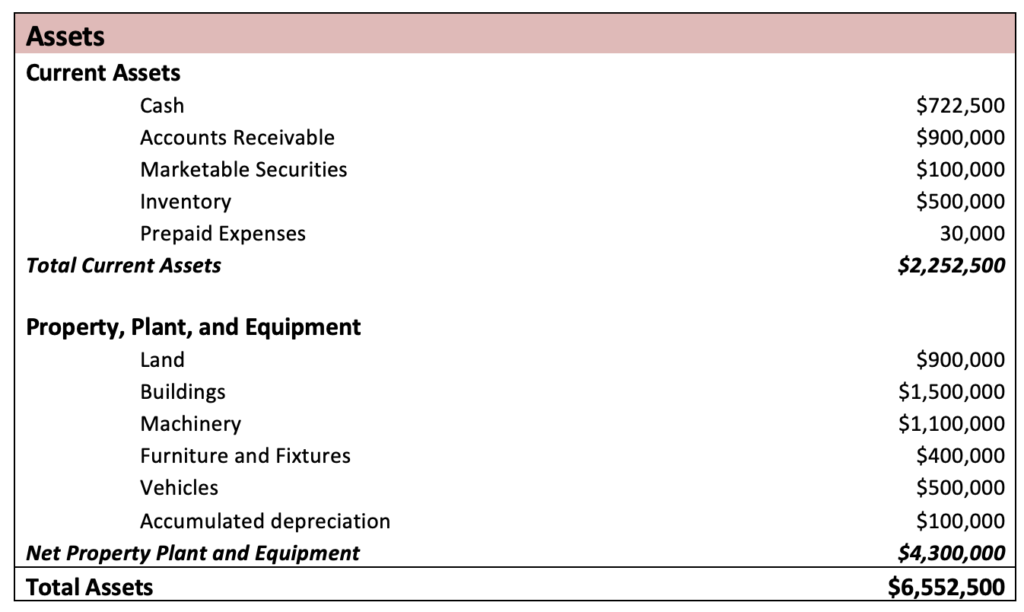

Balance Sheet Property Plant 26 Equipment From Trial Balance 13

Valuation of equipment assets on the balance sheet is initially at the purchase price, which includes the cost to acquire, deliver, and. No, your equipment is not a current asset. Balance sheets are typically prepared and distributed monthly or quarterly depending on the governing laws and company. Is equipment a current asset? When equipment is purchased, it is not initially.

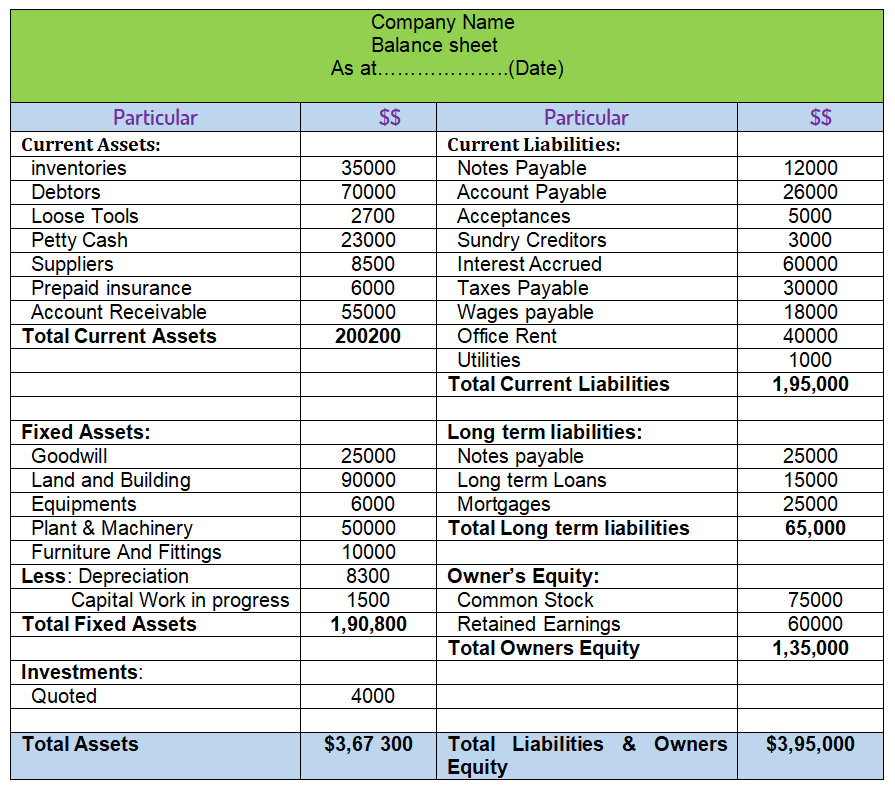

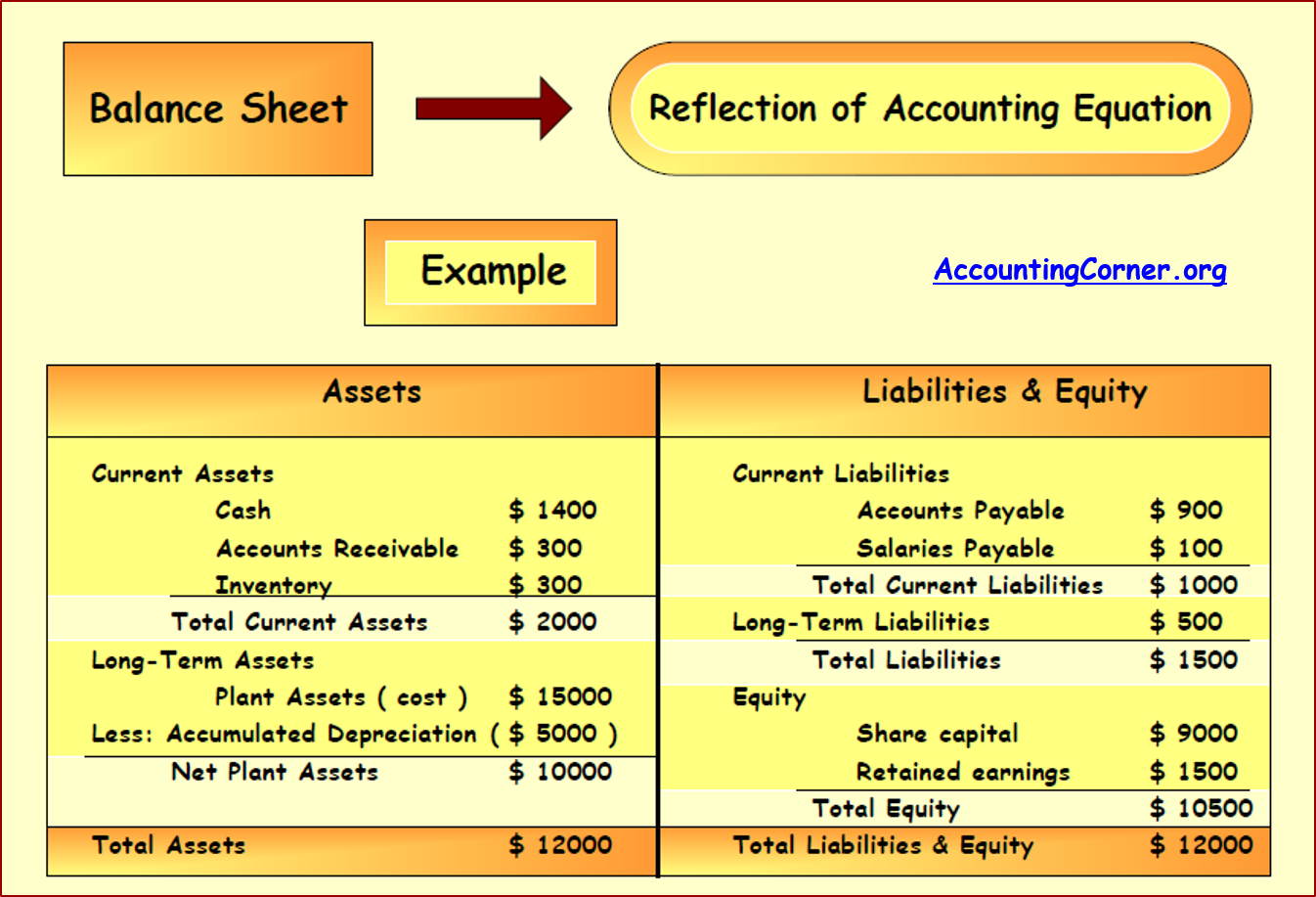

Balance Sheet Format Explained (With Examples) Googlesir

Instead, it is reported on the balance sheet as. Valuation of equipment assets on the balance sheet is initially at the purchase price, which includes the cost to acquire, deliver, and. Balance sheets are typically prepared and distributed monthly or quarterly depending on the governing laws and company. Is equipment a current asset? Instead, your equipment is classified as a.

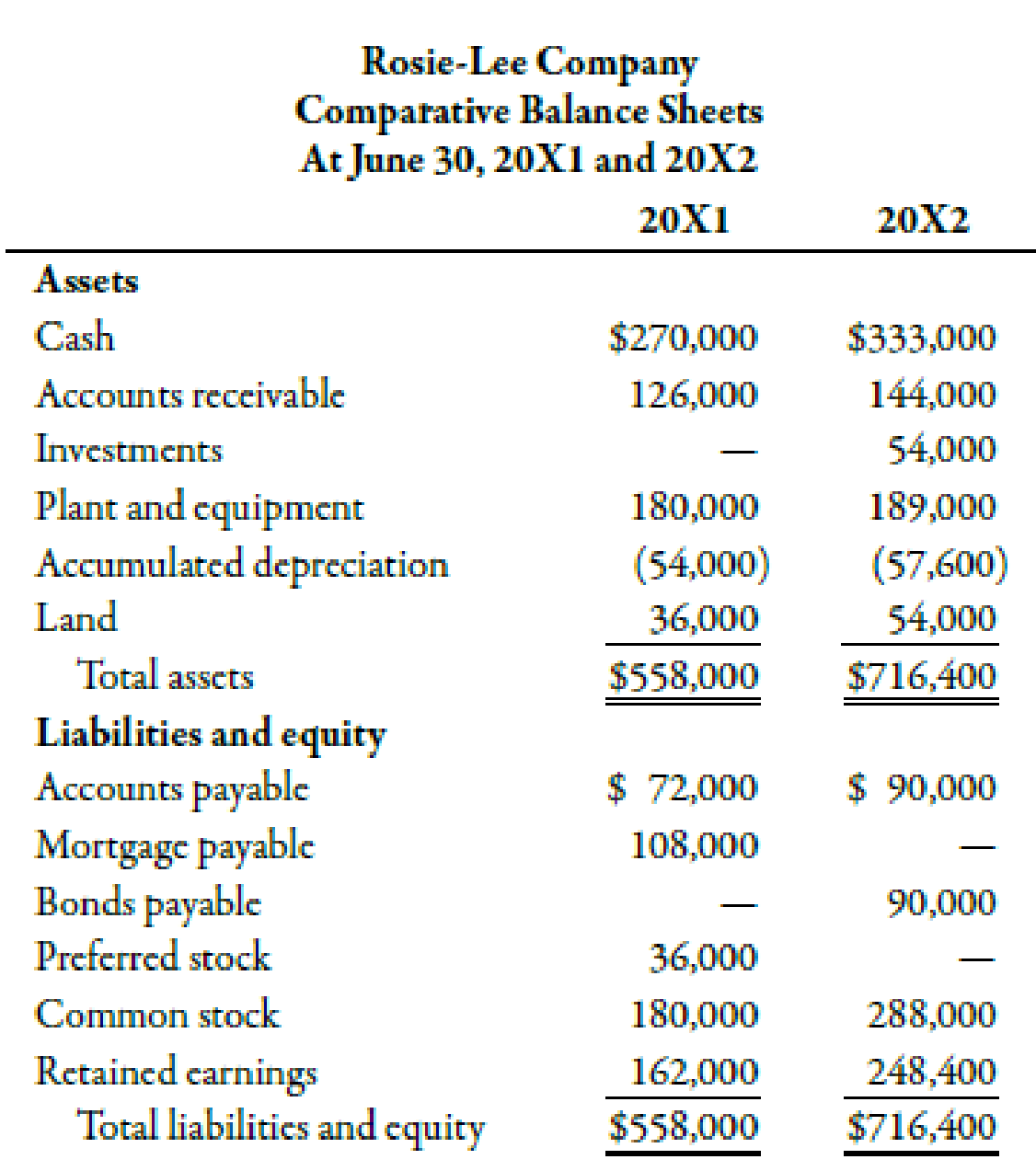

What Is Accumulated Depreciation Equipment On A Balance Sheet at Idell

Instead, it is reported on the balance sheet as. When equipment is purchased, it is not initially reported on the income statement. Instead, your equipment is classified as a noncurrent asset. Recording equipment accurately on the balance sheet is critical for reflecting a company’s financial position. Balance sheets are typically prepared and distributed monthly or quarterly depending on the governing.

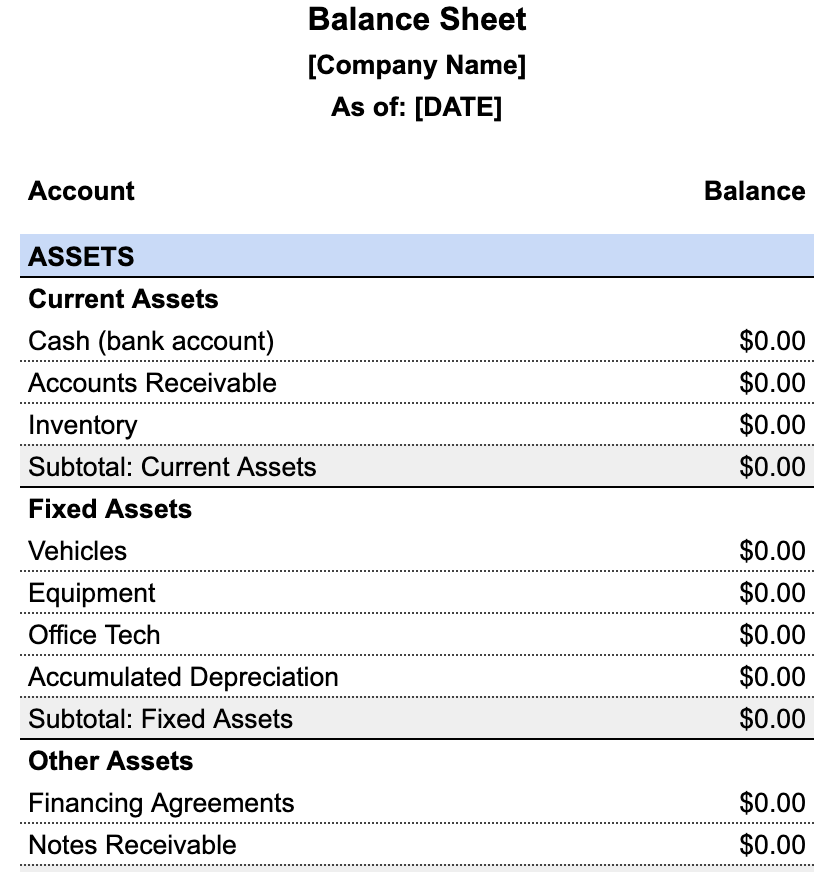

Beginner's Guide To Understanding Your Balance Sheet (1) Elements Of

When equipment is purchased, it is not initially reported on the income statement. Balance sheets are typically prepared and distributed monthly or quarterly depending on the governing laws and company. Is equipment a current asset? Instead, your equipment is classified as a noncurrent asset. Valuation of equipment assets on the balance sheet is initially at the purchase price, which includes.

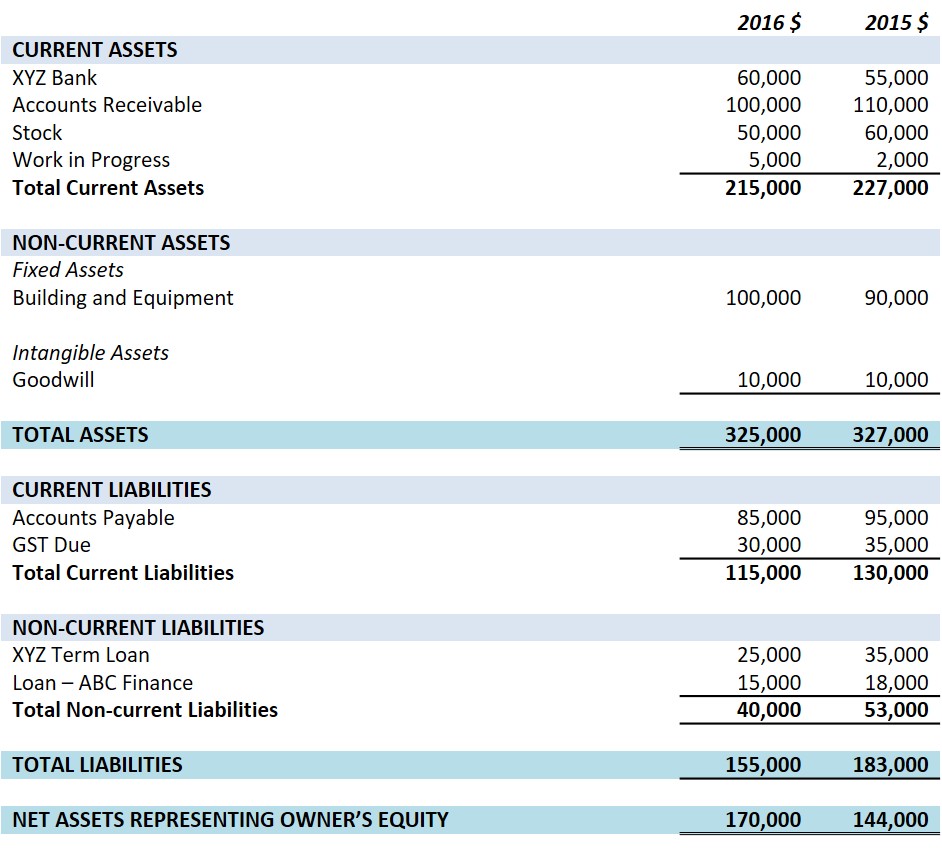

Asset Side of the Balance Sheet

No, your equipment is not a current asset. Is equipment a current asset? Instead, your equipment is classified as a noncurrent asset. Recording equipment accurately on the balance sheet is critical for reflecting a company’s financial position. Instead, it is reported on the balance sheet as.

Classified Balance Sheet Accounting Corner

When equipment is purchased, it is not initially reported on the income statement. Valuation of equipment assets on the balance sheet is initially at the purchase price, which includes the cost to acquire, deliver, and. Recording equipment accurately on the balance sheet is critical for reflecting a company’s financial position. Instead, your equipment is classified as a noncurrent asset. Instead,.

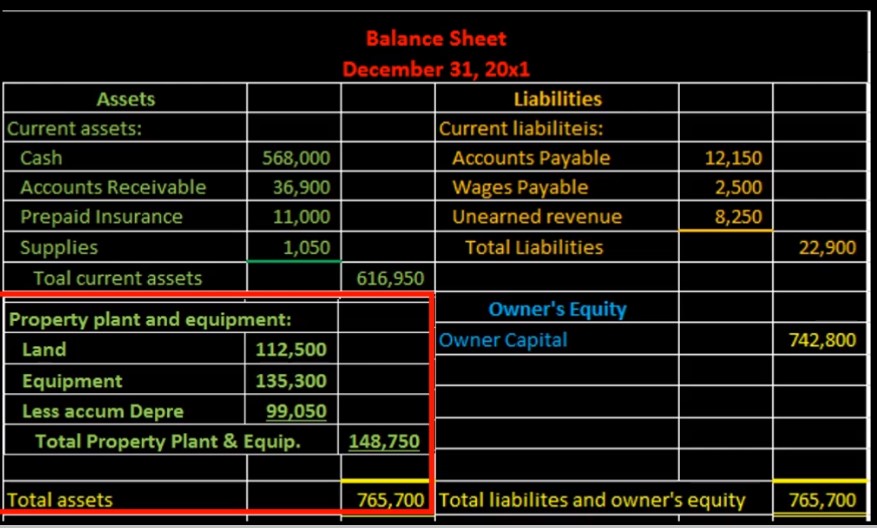

Balance Sheet Example With Depreciation

Recording equipment accurately on the balance sheet is critical for reflecting a company’s financial position. Is equipment a current asset? Balance sheets are typically prepared and distributed monthly or quarterly depending on the governing laws and company. Instead, your equipment is classified as a noncurrent asset. Valuation of equipment assets on the balance sheet is initially at the purchase price,.

The Balance Sheet A Howto Guide for Businesses

When equipment is purchased, it is not initially reported on the income statement. No, your equipment is not a current asset. Balance sheets are typically prepared and distributed monthly or quarterly depending on the governing laws and company. Instead, it is reported on the balance sheet as. Recording equipment accurately on the balance sheet is critical for reflecting a company’s.

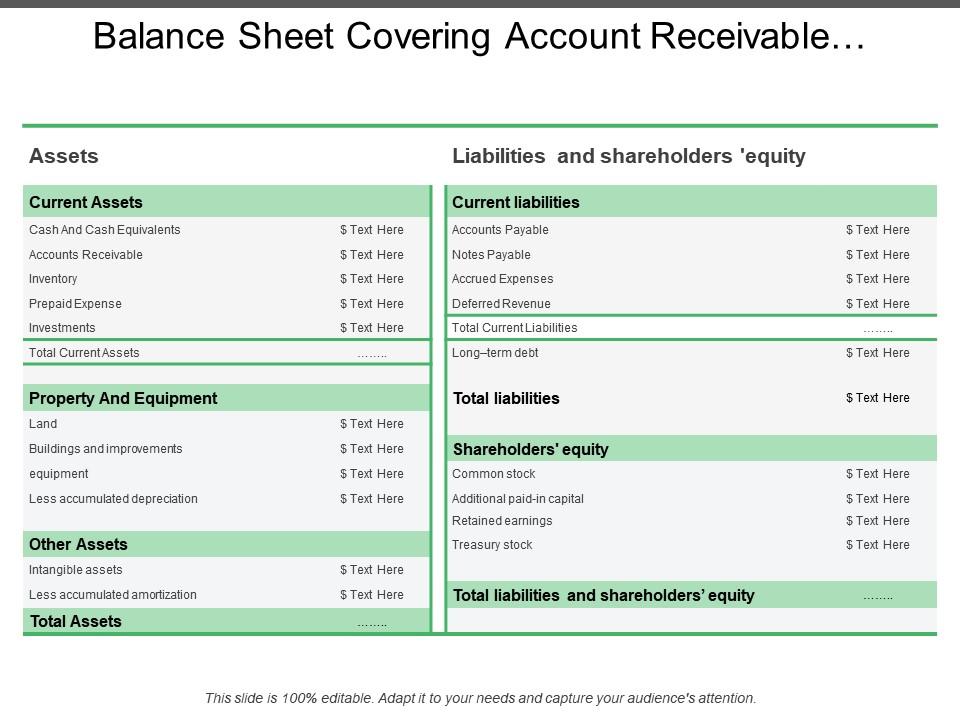

Balance Sheet Covering Account Receivable Property And Equipment

Valuation of equipment assets on the balance sheet is initially at the purchase price, which includes the cost to acquire, deliver, and. Instead, your equipment is classified as a noncurrent asset. When equipment is purchased, it is not initially reported on the income statement. Recording equipment accurately on the balance sheet is critical for reflecting a company’s financial position. Instead,.

Is Equipment A Current Asset?

Instead, it is reported on the balance sheet as. When equipment is purchased, it is not initially reported on the income statement. Instead, your equipment is classified as a noncurrent asset. Balance sheets are typically prepared and distributed monthly or quarterly depending on the governing laws and company.

Valuation Of Equipment Assets On The Balance Sheet Is Initially At The Purchase Price, Which Includes The Cost To Acquire, Deliver, And.

No, your equipment is not a current asset. Recording equipment accurately on the balance sheet is critical for reflecting a company’s financial position.